Our History

From our start in 1916, Farm Credit has served rural communities and agriculture. For more than 100 years, we have supported farmers and ranchers throughout rural America. We draw on those experiences as we look to the future.

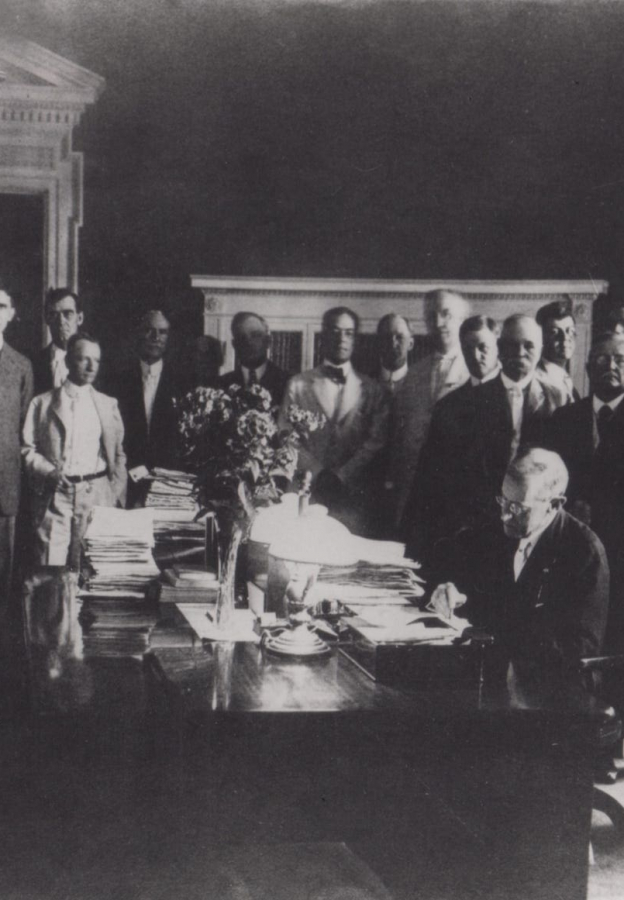

July 17, 1916

Founding the System

President Wilson signs the Federal Farm Loan Act, which created the Federal Farm Land Bank system.

The Federal Farm Loan Act originated in work conducted by private and government commissions dating back to 1908.

The Act provided for a Federal Farm Loan Board, 12 Federal Land Banks (FLBs) to raise and disburse funds, cooperative National Farm Loan Associations to make real estate loans to farmers and ranchers and the organization of for-profit Joint Stock Land Banks.

On April 10, 1917, A. L. Stockwell of Larned, Kansas, received the System’s first long-term, low interest, amortized agricultural loan.

March 4, 1923

New Credit, New Service, Better Funding

The Agricultural Credits Act of 1923 extends service and provides for short-term and intermediate operating credit, while the System strengthens its funding capability.

The new legislation provided for 12 Federal Intermediate Credit Banks (FICBs) intended to finance short-term commercial loans and to make direct loans to cooperatives. The legislation also extended the Federal Land Bank System to Alaska and Puerto Rico. That same year, the Federal Farm Loan Board created a Fiscal Agency, to more effectively market the bonds which provided credit for the system.

June 16, 1933

The Great Depression

In the midst of a Great Depression, even greater for agriculture, the System is rescued and expanded, saving countless American farms.

The Farm Credit Act of 1933 established Production Credit Associations (PCAs) to make short-term loans timed to agricultural cycles, and Banks for Cooperatives (BCs) to lend to cooperatives.

A month earlier, separate legislation had recapitalized the Federal Land Banks and provided for emergency “commissioner loans.”

In 1933 and 1934 alone, the System, now regulated by the Farm Credit Administration, loaned more than $2 billion to help farmers and ranchers refinance and keep producing.

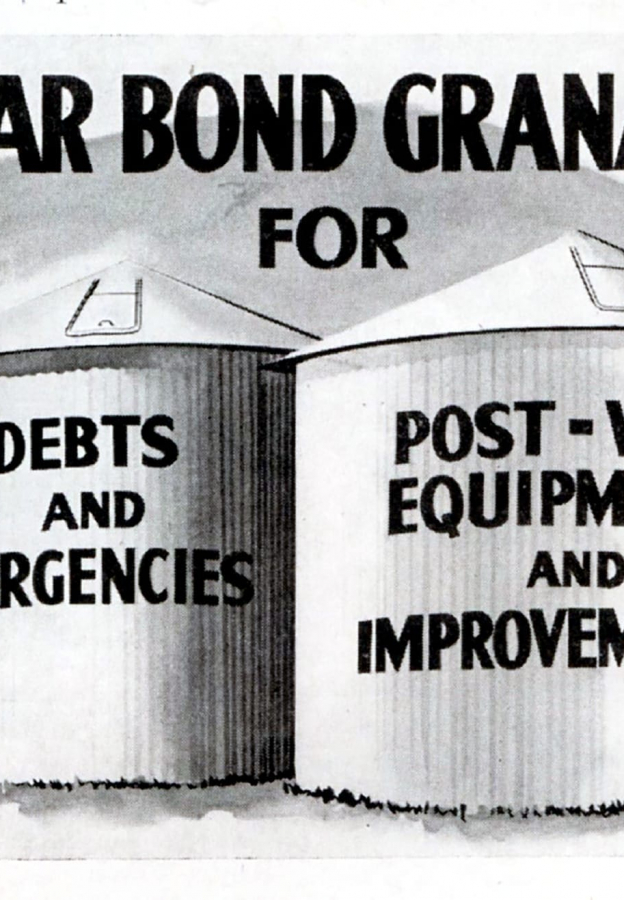

December 10, 1941

Production for the War

Three days after Pearl Harbor, officials of the Bank for Cooperatives meet to set new priorities – the Farm Credit System prepares to fight inflation and feed a nation at war.

Occupying a strategic position in the nation’s food supply chain, the Banks for Cooperatives financed the production and marketing of war-critical foods, fibers and oils.

The FLBs helped to stem inflation by continuing to appraise farmland on the basis of “normal value” (the general level of prices from 1909 to 1914) rather than wartime prices.

To further the USDA “Food-for-Freedom” campaign, PCAs reduced the cost of credit to member-borrowers.

December 4, 1953

An Independent Path

The Farm Credit Act of 1953 makes the Farm Credit Administration an agency of the Executive Branch and sets the System on a path toward independence.

After years as a part of the USDA’s comprehensive agricultural program, the Farm Credit Administration got independent regulator status, directed by the Federal Farm Credit Board (FFCB). Most FFCB members were chosen from within the System—they appointed the Governor of the Farm Credit Administration. The movement toward independence began in 1947 when the Federal Land Banks paid off the last of the federal capital provided during the Great Depression.

December 2, 1971

Full Borrower-Ownership, New Charter

Comprehensive legislation completely updates the charter of the newly borrower-owned System, broadening its lending authority.

The Farm Credit Act of 1971 was the culmination of work begun after the PCAs and BCs retired the last of their government capital on December 31, 1968.

The legislation drew upon recommendations made by a 27-member Commission on Agricultural Credit that spent nearly a year in study.

The 1971 Act allowed for commercial fishing loans, purchase of non-farm rural homes, and raised property lending limitations from 65 to 85 percent of appraised market value.

December 24, 1980

Expanding Authority, Greater Responsibility

The Farm Credit Act amendments of 1980 broaden the System’s lending authority, provide for the creation of service organizations and recognize the System’s commitment to young, beginning and small farmers.

The 1980 amendments authorized the Banks for Cooperatives to participate in international lending and eased restrictions on their lending to rural, electric, telephone, and public utility cooperatives.

The legislation also provided for the creation of Service Organizations enabling the system to undertake tasks previously handled by The Farm Credit Administration.

The 1980 amendments formalized an initiative begun years earlier by requiring each Farm Credit District to create a program helping young, beginning and small (YBS) farmers to get established.

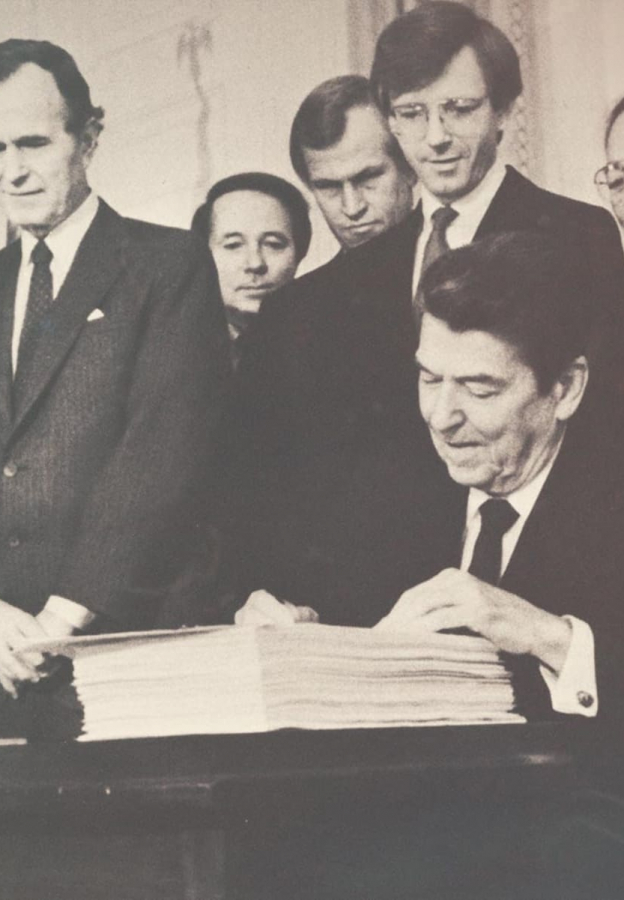

January 6, 1988

Farm Crisis: Toward Solvency and a New Structure

In the midst of an extended farm crisis, the Agricultural Credit Act of 1987 — the second important piece of legislation in as many years — provides federal financial assistance and requires the System to reorganize.

The Farm Crisis of the 1980s was created by changing external factors that led to overproduction, high interest rates and plunging land values. After 1985 legislation failed to enable the System to rescue stressed institutions, the 1987 Act abolished the Federal Farm Credit Board and created a new Farm Credit Administration board with enforcement powers. The 1987 Act provided financial assistance and directed mergers and other reorganizations to create a leaner, stronger System.

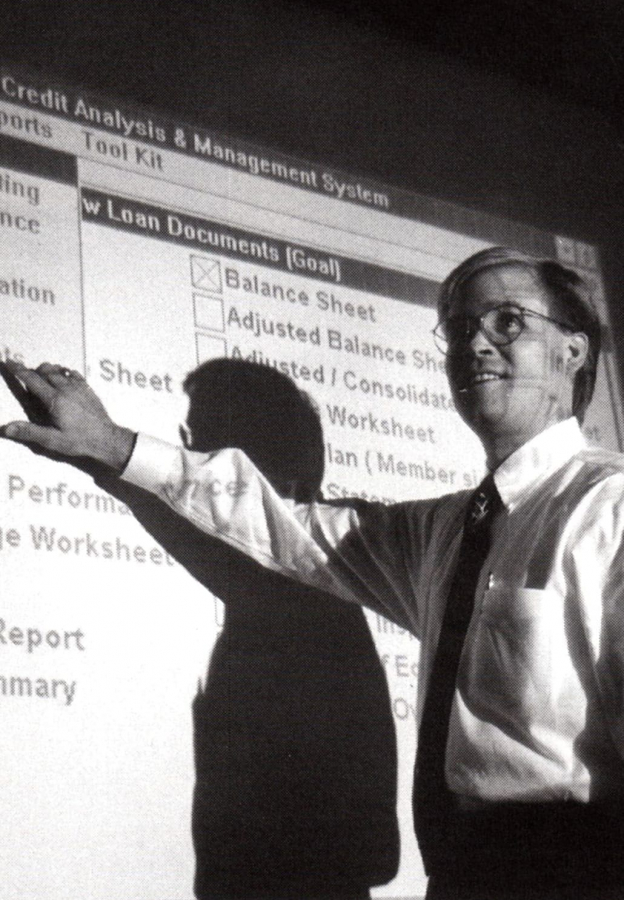

October 1, 1999

Associations Restructure for the Future

After more than a decade of experimentation, the “Parent ACA” arrangement was developed, setting the pattern for subsequent mergers on the association level.

After 1987, most members of the Cooperative Lending System merged to form CoBank, while Federal Land Bank Associations either converted to direct-lending Federal Land Credit Associations (FLCA) or joined with PCAs to become ACAs.

Through these efforts, the System was reduced from 404 lending organizations at the close of 1987 to just 185 at the time of the development of the parent ACA.

Because it provided cost savings and increased flexibility, within just a few years, the parent/subsidiary arrangement developed in 1999 became common throughout the Farm Credit System.

June 10, 2005

Paid in Full

Twenty years after the peak of the farm crisis, the System repays the last of the federal capital provided during the emergency, returning to fully borrower-owned status.

The Agricultural Credit Act of 1987 authorized creation of the Farm Credit System Financial Assistance Corporation (FAC), which loaned federal funds to distressed institutions.

In 1994, the Farm Credit Bank of Spokane paid down half of its loan 11 years early, providing the FAC with a bond to cover the rest.

With payment of that bond, along with all interest involved in the FAC loan program, the System drew a line under one of its toughest times and ushered in a new, borrower-owned future.

July 17, 2016

Farm Credit 100

Farm Credit marks its centennial and looks ahead to continue serving as the financial underpinning of U.S. agriculture and rural America.