Our Mission

Farm Credit supports rural communities and agriculture with reliable, consistent credit and financial services, today and tomorrow. For more than 100 years, Farm Credit has fulfilled its mission – through good times and bad.

To fulfill our mission, Farm Credit raises funds in the world’s capital markets and invests them in rural America. This steady flow of capital creates jobs and drives economic growth. Farm Credit helps ensure the vibrancy of communities throughout rural America.

As customer-owned cooperatives, each independent Farm Credit financial institution has a board of directors chosen by the customers it supports. This structure ensures a customer-first approach that helps producers feed the world, strengthens the rural economy and provides jobs that help rural families thrive.

Who We Serve

We serve every part of agriculture from the smallest operations to the largest – and everything in between. Whether helping a young farm family begin, supporting our veterans as they return home and take up farming or financing U.S. agricultural exports around the globe, Farm Credit is committed to the success of American agriculture.

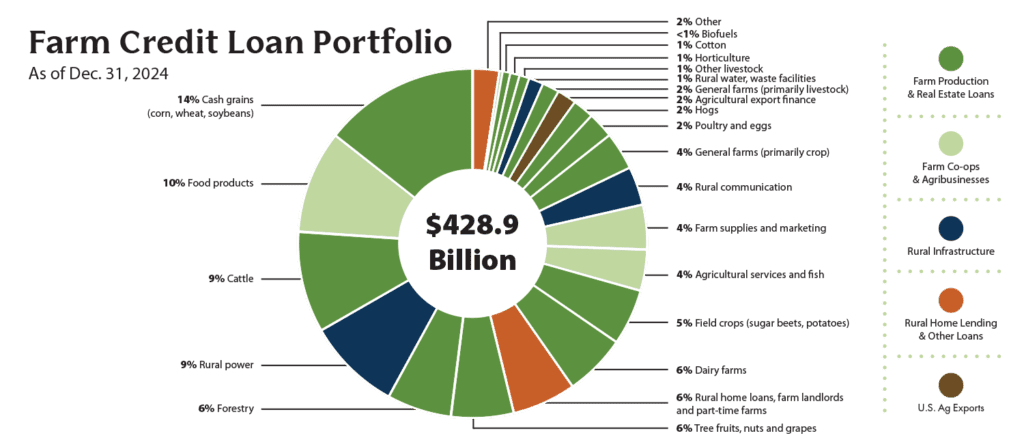

Our loans and related financial services support farmers and ranchers, farmer-owned cooperatives and other agribusinesses, rural homebuyers and companies exporting U.S. ag products around the world.

We live in the rural communities we serve and understand that vibrant rural communities need strong, modern infrastructure. Farm Credit loans help finance the rural infrastructure providers that provide reliable power, modern telecommunications, clean water and other vital community services.

For more than 100 years, Farm Credit has fulfilled its mission – through good times and bad. We remain committed to that mission, and to evolving to meet the needs of our customers for the next 100 years.

How We Serve

Our nationwide network of customer-owned financial institutions offers a wide range of financial products specifically tailored to the individual needs of agricultural producers, farmer-owned cooperatives and other agribusinesses, commercial fishers, rural homebuyers and rural infrastructure providers.

Farm Credit’s financial strength means that our customer-owners have access to the most modern loan products available, from the smallest loan to a farmer starting out to a large multi-lender loan syndication needed to bring broadband to an entire rural community.

For agricultural producers, we make loans to buy land, operate farms, purchase equipment, build facilities and much more. We also offer crop insurance, credit life insurance and other financially related services.

For farmer-owned cooperatives and other agribusinesses, we make loans to acquire land, build facilities, purchase inventory, extend credit to customers, export products and more. We also offer cash management services and other financially related services.

We offer specialized leasing programs so our customers can lease equipment, facilities, rolling stock and more.

We make loans to individuals and families to purchase homes in rural areas.

We make loans to rural infrastructure providers to support operations, acquire/build facilities, support mergers and acquisitions, finance individual projects and for general corporate purposes.

Our Customers,

Our Mission

Our customers are at the heart of everything we do. Learn more about our mission and hear stories from across the country.

Wright’s Dairy Farm and Bakery

North Smithfield, Rhode Island