WASHINGTON, D.C. – Farm Credit System institutions made 150,156 loans to young, beginning, and small U.S. producers in 2024, delivering on their ongoing mission to support rural communities and agriculture, according to a new Farm Credit Administration (FCA) report. These results underscore Farm Credit’s commitment to the next generation of agricultural producers through strategic lending and support initiatives.

“The future of U.S. agriculture is dependent on the next generation,” said Christy Seyfert, President and CEO of the Farm Credit Council. “Farm Credit is proud to deliver on our ongoing commitment to supporting young, beginning and small producers as evidenced through this report.

“Each Farm Credit institution affirms its’ support to young, beginning and small producers through a range of resources reflective of the agricultural industry within their geographic footprint,” Seyfert added.

2024 Highlights:

- During 2024: Farm Credit System institutions made 150,156 loans to young, beginning, and small U.S. producers, totaling $33.1 billion. More than half (58%) of all loans made by Farm Credit lenders in 2024 were made to young, beginning, or small producers.

- Year-End 2024: Farm Credit had nearly $122.8 billion in loans outstanding to young (under age 35), beginning (less than 10 years ag production experience), or small (under $350,000 in annual gross cash farm income) U.S. producers and year-end 2024.

Throughout 2024, Farm Credit Supported:

- Young Producers: 50,143 loans totaling $13.5 billion were made to young producers who are 35 years old or younger.

- Beginning Producers: 72,612 loans totaling $20.6 billion were made to beginning producers who have 10 years or less of experience.

- Small Producers: 121,201 loans totaling $18.1 billion were made to producers with less than $350,000 in annual gross cash farm income.

- Non-Lending Services: From 2023 to 2024, there was a year-over-year increase to the number of YBS Advisory Committees, YBS board members, dedicated YBS staff and training opportunities.

[NOTE: The individual numbers above for young, beginning, or small cannot be combined as producers can be classified in more than one of the categories.]

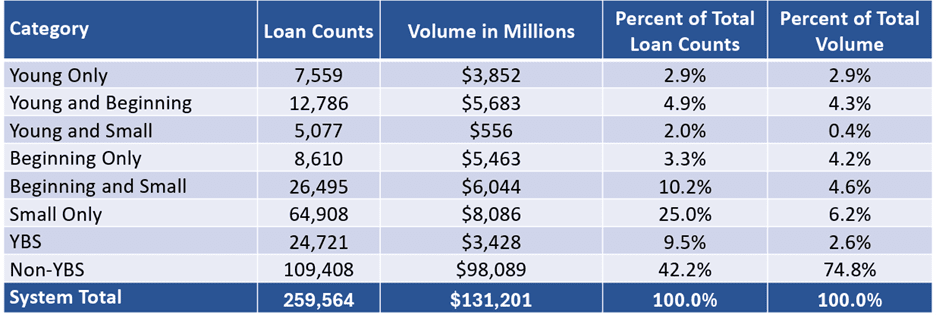

The Farm Credit Administration is an independent federal regulatory agency charged with oversight of the Farm Credit System. It annually reviews Farm Credit’s performance on meeting the needs of YBS farmers and ranchers and reports findings to Congress. This year’s report is the second to incorporate the agency’s new YBS lending rule, which went into effect on February 1, 2024, and includes data on eight distinct YBS and non-YBS groups, ensuring that loans and shared credits are counted only once for accuracy. Due to FCA-mandated changes in methodology and parameters, results from 2024 may not be directly comparable to previous years.

The chart below, excerpted from the FCA report, details NEW loans made during 2024 by Farm Credit System lenders.

Farm Credit supports rural communities and agriculture with reliable, consistent credit and financial services, today and tomorrow. It has been fulfilling its mission of helping rural America grow and thrive for more than a century with the capital necessary to make businesses successful and by financing vital infrastructure and communication services. For more information visit www.farmcredit.com.

###