Learning happens in so many different ways. For some students, in-person education works. For others, online videos help. Still others prefer the less traditional approach of a video game. To teach students how to manage their finances without the risk of real-life financial consequences, Farm Credit partnered with the University of Idaho Extension to create Night of the Living Debt (NLD), a video game designed for high school-aged youth where zombies have taken over the financial world and a failure to pay off their demands will result in a diminished credit score.

NLD was funded by CoBank, a national cooperative bank and provider of wholesale loans to its affiliated Farm Credit associations, but it wouldn’t have happened if not for a chance encounter between Jim Lindstrom, 4-H youth development director at the University of Idaho, and Linda Hendrickson, senior vice president of marketing and public affairs at AgWest Farm Credit.

Lindstrom and Hendrickson started casually chatting as they sat in the bleachers at their daughters’ high school volleyball match. Jim mentioned that he worked for Extension and Linda was excited to share that Farm Credit had helped provide grant funds to his program. Jim detailed all he had been working on with Farm Credit’s support when Linda interrupted, “But Jim, what would you do with real money?” So began the Northwest Youth Financial Education program, which increases financial literacy among youth and young adults.

As the program developed, Linda connected Jim with representatives from CoBank, AgWest’s wholesale bank. CoBank enthusiastically joined in the effort, working directly with University of Idaho’s Luke Erickson and Lyle Hansen to develop NLD, an entirely new element that introduces a unique take on financial education to a broad range of students.

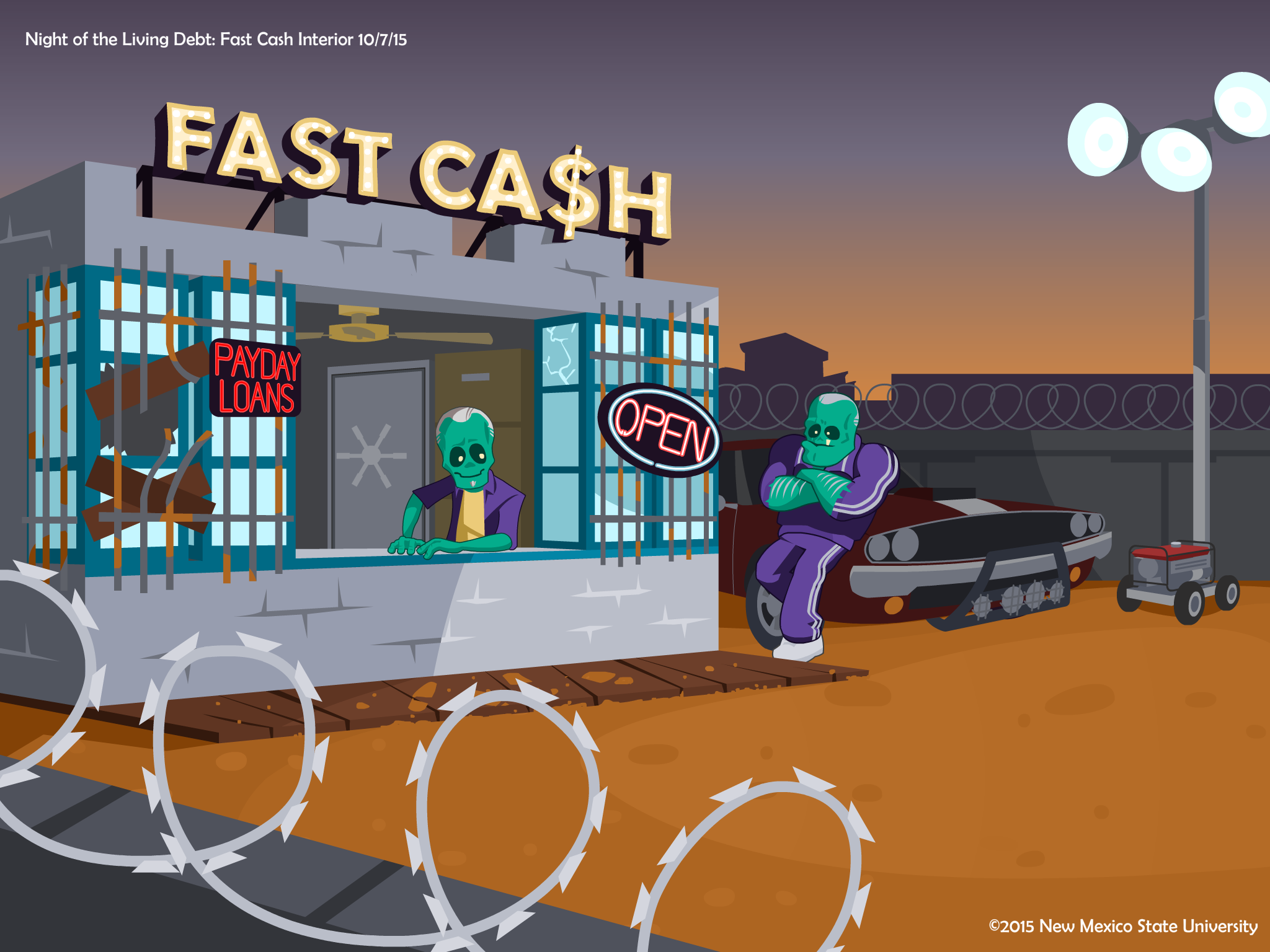

NLD teaches youth vital financial skills like the differences between lenders and the importance of making payments on time, keeping balances low and preparing for financial emergencies. Today, it is one of ten free games housed by the Northwest Youth Financial Education program and has been taught to more than 2,500 individuals through Extension programming. The game has been downloaded more than 1,500 times and played more than 33,000 times since its release in 2014.

The game’s popularity can be attributed to its format and zombie-filled fictional world, which make learning financial skills fun. Erickson, personal finance specialist and associate professor at the University of Idaho, said, “Even if students are lectured about something, until they experience how it works, it will remain mysterious to them … The intent of these games is to allow youth to learn by doing.”

The real marker of success, of course, is the students’ reactions. Describing NLD, one student said, “I think this is good because it teaches us how to save some money so when we are adults, we won’t make mistakes [that hurt] our credit scores.”

Financial skills education has long been a priority for Farm Credit. Linda said, “At AgWest, we are committed to helping people in our rural communities learn and grow. As a lender, we believe that teaching youth about how to manage their money is critically important, as they may not learn these skills at school or from their family.”

Similarly, CoBank is dedicated to going above and beyond to help those they serve. Sherry Johnson, senior manager of corporate social responsibility at CoBank, said, “One of the key priorities in our corporate citizenship efforts is partnership — whether it’s with an affiliated Farm Credit association or one of our cooperative customers. At CoBank, we want our customer-owners to know that we care about what they care about, and nothing gives us greater satisfaction than the opportunity to work together with them to make an already great program even greater.”