Our Structure

Farm Credit’s cooperative structure helps us fulfill our critical mission assigned by Congress – supporting rural communities and agriculture with reliable, consistent credit and financial services, today and tomorrow.

The Farm Credit associations that support 600,000+ customer-owners are divided into four districts. Each district has its own regional wholesale bank. The associations and the specific territories they serve can be viewed here

How We’re Structured

We are a nationwide network of independent, privately-owned lending institutions in all 50 states and Puerto Rico. We are cooperatives – owned by our customers – farmers, ranchers, farmer-owned cooperatives and other agribusinesses, rural utilities and others in rural America. This structure ensures customer needs always come first, and they share in their respective institution’s success.

The net income generated by Farm Credit institutions can be used in only two ways: retained within a Farm Credit institution as capital to build our financial strength, which ensures reliable service, or passed on to our customer-owners by way of patronage dividends. These dividends effectively lower the cost of borrowing for farmers and ranchers across the country. In 2023, Farm Credit collectively returned $3.08 billion to farmers and ranchers. Since 2012, Farm Credit has returned more than $21 billion in patronage dividends.

Our Unique Funding Model

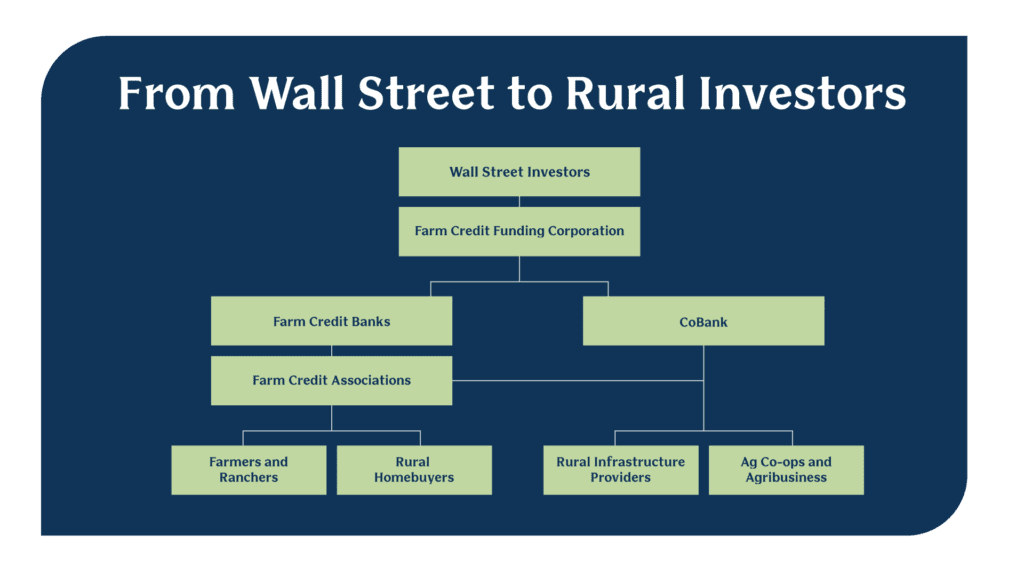

Although Congress created Farm Credit in 1916, we do not receive any government funding or tax dollars. Instead, Farm Credit reverses the traditional flow of funds by raising money on Wall Street and bringing it back to rural communities.

Farm Credit raises funds by selling debt securities on the nation’s money markets through the Federal Farm Credit Banks Funding Corporation. Farm Credit insures its debt through the Farm Credit System Insurance Corporation, a self-funded insurance entity. With consistently strong ratings, Farm Credit delivers competitive interest rates on loans for our customer-owners, irrespective of financial conditions in the agriculture industry and rural America.

Once the Funding Corporation issues debt securities on behalf of all Farm Credit institutions, the four regional wholesale banks, AgFirst, AgriBank, CoBank and Farm Credit Bank of Texas, fund the individual Farm Credit associations who support farmers, ranchers and rural homebuyers. In addition to funding local retail associations, CoBank also uses the proceeds from Farm Credit debt securities to make loans directly to farmer-owned cooperatives, rural infrastructure providers and other agribusinesses.

Oversight

The Farm Credit Administration (FCA), an independent federal financial regulatory agency, regulates the Farm Credit System.

The FCA is the regulatory body that writes and examines the regulations that govern Farm Credit institutions. Members of the FCA’s Board of Directors are appointed by the President of the United States and confirmed by the U.S. Senate.

Farm Credit also interacts with other federal agencies, including the U.S. Treasury Department and U.S. Department of Agriculture. Farm Credit is committed to ensuring both the FCA and other federal agencies understand the continued value of our mission to serve rural communities and agriculture.

You can view communications from Farm Credit – including letters and official comments – to the FCA by clicking here.

Farm Credit Council

The Farm Credit Council is the national trade association representing the institutions of the Farm Credit System before Congress, the Executive Branch and others. Learn more about the Farm Credit Council.