The Reids prioritize conservation, working day in and day out to ensure the sustainability of their farm for years to come.

Brooks and Stephanie Reid farm in Chariton County, Missouri. Brooks started farming his first 160 acres in 1998. He was a freshman in high school and the farm was his Supervised Agricultural Experience (SAE) for FFA. “The farm had been abused,” Brooks said. “It was in rough shape.” And with that, Brooks stepped into an opportunity to continue his family’s tradition of conservation-focused, progressive farming.

A Commitment to Conservation

That same year, there was an opportunity through a government program to cost-share on no-till equipment. With his no-till planter, some help from his dad and wisdom from his grandpa, Brooks started the slow process of turning the farm around and making it more sustainable. “My grandpa was very conscious about conservation and stewarding the ground,” Brooks said. That year, his first 160 acres made 90-bushel corn.

Building a knowledge base in soil science

By 2002, Brooks graduated from high school and found himself balancing college courses alongside the farm.

After graduating with an agronomy degree from Northwest Missouri State University, Brooks took on a role with DeKalb County Soil and Water Conservation District, further developing his soil conservation knowledge.

He farmed on evenings and weekends until 2010, when he decided it was time to pursue farming full time. Although he had made some progress on the original 160 acres during this time, the next two decades would bring even more growth.

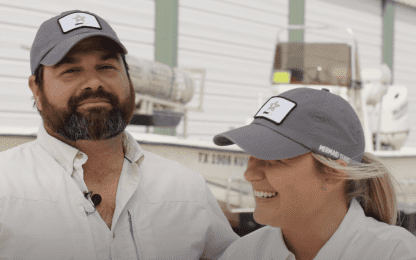

A team effort

In 2007, Brooks married Stephanie, a farm girl he met in FFA. Stephanie’s father, a full-time postal worker, farmed bottomland that was subject to destructive floods in 1993 and 1995 on the weekends. “That was traumatizing, having the floodwaters right up to our front yard,” Stephanie said.

Despite her youthful declaration to “never marry a farmer,” Stephanie and Brooks decided to build a life together. “I said I would never marry a farmer because I saw how hard my dad worked and didn’t want that lifestyle,” Stephanie said. “So, I married a hill farmer.”

Together, the couple got serious about technology, conservation and sustainability. “We are trying to heal the ground so that our son has something to farm,” Stephanie said.

The benefits of cover crops

In addition to no-till farming, Brooks was one of the first in the area to start using cover crops on his farms. He credits his grandfather, his father and Dr. Jamie Patton, a soil professor at Northwest Missouri State University, for all helping to shape his mindset.

He was inspired to throw some rye out with fertilizer to see what it would do. “At the least we’d be able to tell how well the fertilizer man did spreading,” he joked. “We’d be able to see where he missed.”

But it ended up being much more beneficial than he’d imagined. Since that time, Stephanie and Brooks have incorporated even more cover crops on their farms. “I like to plant green now,” Brooks said, meaning he chooses to plant a cash crop right into a growing cover crop.

“There is a learning curve with cover crops,” he said. “That’s why some of these cost-share programs that have been introduced more recently are so important. It allows us to try some things and, if we fail, it’s not a complete business failure.”

Farm Credit was there to help

In 2011, Stephanie and Brooks hit a roadblock when the bank they had worked with changed directions. “There were some changes at the bank and it was like they didn’t want to work with us anymore,” Brooks said.

For a short time, he relied on supplier input financing but knew that was not going to work because of the restrictive options. “I basically had to buy whatever product they sold. Not what was right for our farm,” he said.

Brooks filled out an inquiry form on the FCS Financial website and loan officer Jordan Harmon reached out to him. Brooks and Stephanie quickly built a relationship with FCS Financial and Jordan has served the family ever since.

“Brooks is one of the most progressive farmers I work with,” Jordan said. “Most of the time when he calls me needing money to do something new, it’s something I haven’t heard of anyone else around here doing yet. But he always has a plan. And after going through the FCS Financial Connect program, the quality of data that he and Stephanie provide has really improved. It makes it easy to work with them.”

To farm the way he and Stephanie want to farm, Brooks says doing his homework is an important step in obtaining capital. “I always show Jordan what I want to do, why I want to do it and how it’s going to pay.”

Technology, a helpful tool

The couple also has an intense focus on technology, which allows them to better manage every inch of their farms. The planters, sprayers and combines are all equipped with GPS precision technology, so that they can communicate to each other, while instantly pushing data to the cloud.

“Every row has to contribute,” Brooks said. “I am watching every row.”

Technology also takes the guessing game out of the equation. “We have data that we can look back at and figure out what went wrong or what needs to change,” he said.

A long road to success

Stephanie and Brooks have come a long way from where they started. “In 2014, I hit over 200-bushel corn for the first time and that first 160 acres was the farm to do it,” Brooks said, feeling as if they’d finally come close to attaining his goal of healing his family’s farmland after years of hard work.

While the Reids are nowhere close to being done, they are starting the next chapter. This year, Stephanie and Brooks’ 11-year-old son will start managing his own farm. “He’s taking over a 40-acre farm that has been in my family for over 114 years,” Stephanie said. “Just the other day he was looking up corn to plant and doing the research he needed to get ready.”

“His dad is going to guide him. And he’s going to continue the family tradition,” Stephanie said with a smile.

This story first appeared as an article on the FCS Financial website.